In the financial and accounting world, there is a simple yet essential tool: a classified balance sheet. It gives a deeper look into the pulse of an enterprise due to its sub-classification of assets, liabilities, and equity into subgroups, and it allows more understanding to the stakeholders on financial data. This article will define what a classified balance sheet is, the constituents of its content, and its importance concerning business accounting.

What is a Classified Balance Sheet?

A classified balance sheet is the form of financial statement showing a separation of assets, liabilities, and stockholders’ equity. Unlike the simple balance sheet, in which items are all listed in their lot without segregation, the classified balance sheet presents its elements in more specific groupings to further improve readability and usability.

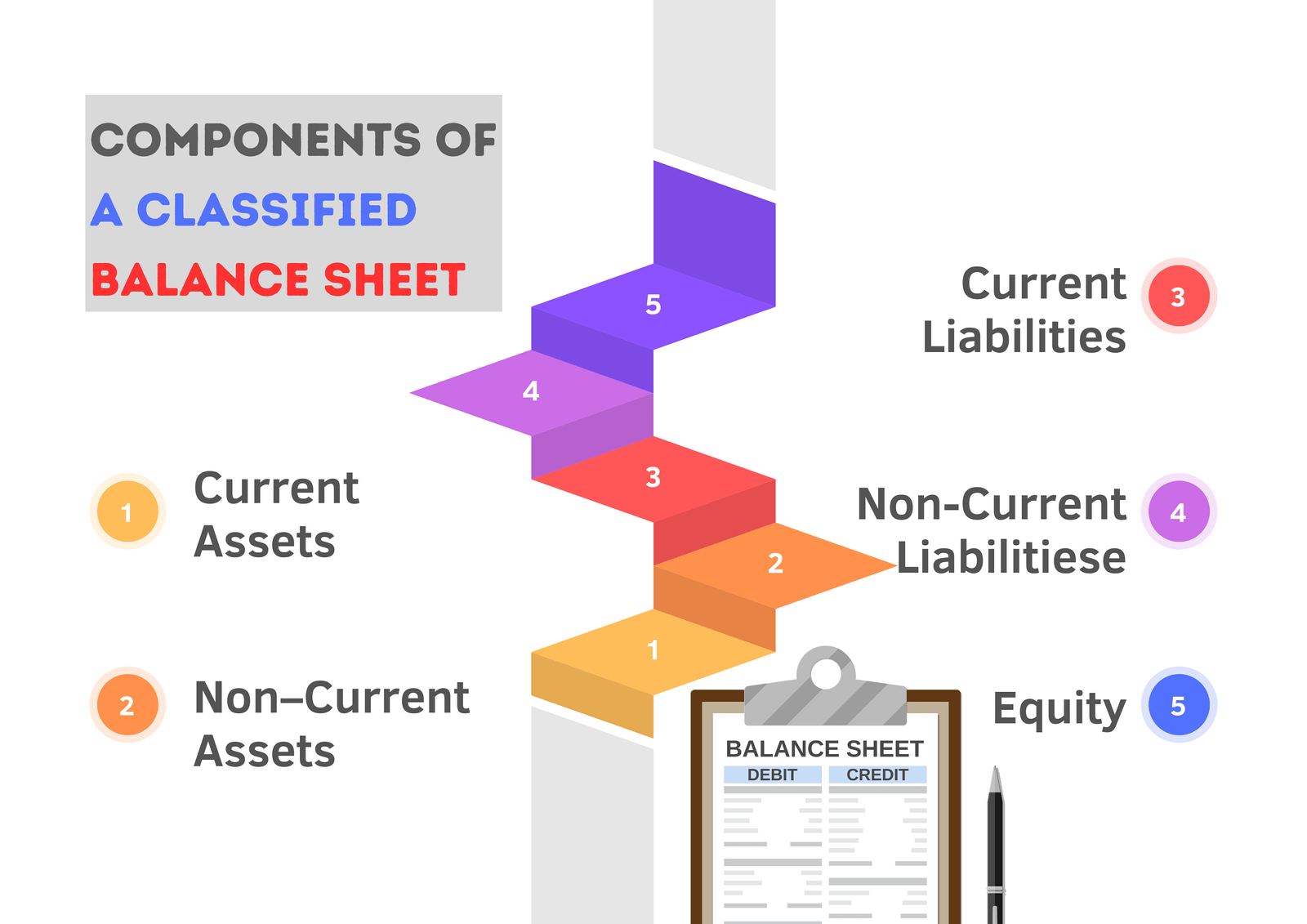

Components of a Classified Balance Sheet

A Classified Balance Sheet normally includes the following categories:

Current Assets: It means the assets which are expected to be turned into cash or used up in one year. Many common examples include cash, account receivables, inventory, and short-term investments.

Non–Current Assets: Also known as long-term assets, these are the types of assets that it has no intention of converting into cash within a year. It includes property, plant and equipment (PP&E), long-term investments, and intangible assets such as patents and trademarks.

Current Liabilities: These are the liabilities which a business enterprise predicts to pay within one year. Examples include Accounts Payables, Short-term Loans, and Accrued Expenses.

Non-Current Liabilities: These are the liabilities not due within one year. Non-current liabilities are those that include items such as long-term debt, deferred tax liabilities, and pension obligations.

Equity: It refers to the residual interest of the owners in the company’s assets. Normally, equity is classified under common stock, retained earnings, and additional paid-in capital.

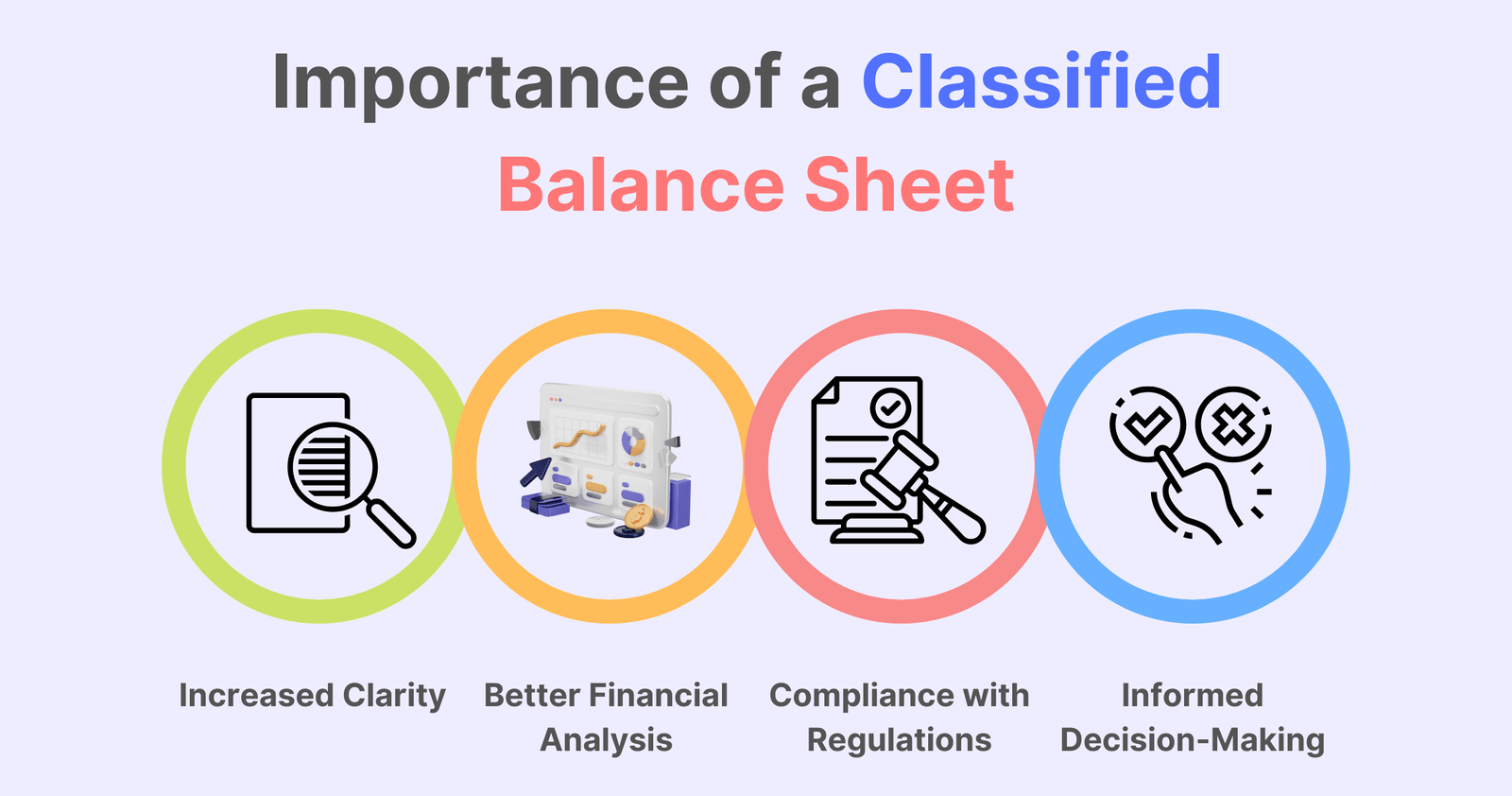

Importance of a Classified Balance Sheet

Classified Balance Sheet—Increased Clarity: This type of balance sheet provides a further breakdown of assets and liabilities into current and non-current, hence giving an increased view of the financial situation of the company to investors, creditors, and the management for better decision-making.

Better Financial Analysis: Grouping enables better financial analysis and ratio calculations. One such major ratio indicating liquidity in business in the short term is the current ratio, which refers to the Quotient of the business’s current assets divided by the current liabilities.

Compliance with Regulations: Most of the regulatory bodies and accounting standards enforce requirements to have businessmen present a classified balance sheet. This is done to ensure transparency and consistency in presentation regarding financial information.

Informed Decision-Making: Detailed financial information makes long-term planning and decision-making processes possible. It can help the management evaluate the working efficiency of the company, its financial stability, and its investment potential.

How to Prepare a Classified Balance Sheet?

The steps for preparing a classified balance sheet are as follows:

Gather all the financial data: It includes trial balances, ledger accounts, and supporting documents relating to such accounts.

Classify Assets and Liabilities: Separate current and non-current assets and liabilities by liquidity and respective maturities.

Calculate Total: Totals should be calculated by adding up all of the current and non-current assets, current and non-current liabilities, and total assets.

Equity: Compute the sum of Common Stock, Retained Earnings and Additional Paid–in–Capital.

Form of Balance Sheet: The balance sheet should be presented in a standard form of a classified balance sheet with clarity and consistency for headings and sub-headings of each category.

Example of a Classified Balance Sheet

Here is a simplified example of a classified balance sheet for a hypothetical company, ABC Corp., as of December 31, 2023:

ABC Corp. Classified Balance Sheet As of December 31, 2023

Assets

Current Assets:

- Cash: $40,000

- Accounts Receivable: $60,000

- Inventory: $30,000

- Short-term Investments: $20,000

Total Current Assets: $150,000

Non-Current Assets:

- Property, Plant, and Equipment: $450,000

- Long-term Investments: $100,000

- Intangible Assets: $50,000

Total Non-Current Assets: $600,000

Total Assets: $750,000

Liabilities

Current Liabilities:

- Accounts Payable: $50,000

- Short-term Loans: $30,000

- Accrued Expenses: $10,000

Total Current Liabilities: $90,000

Non-Current Liabilities:

- Long-term Debt: $150,000

- Deferred Tax Liabilities: $20,000

Total Non-Current Liabilities: $170,000

Total Liabilities: $260,000

Equity

- Common Stock: $350,000

- Retained Earnings: $100,000

- Additional Paid-in Capital: $30,000

Total Equity: $480,000

Total Liabilities and Equity: $740,000

Common Mistakes to Avoid

Misclassification: Assets and liabilities are classified correctly as current or non-current. Misclassification may result in incorrect financial analysis and hence the wrong decisions.

Avoid Details: Provide enough detail in every category; do not treat everything to be thrown together without proper breakdowns.

Inconsistent Formatting: Ensure that the balance sheet follows the same format and structure throughout to prevent discrepancies.

Ignore Adjustments: When it comes to preparation of financial statements, remember to include some necessary adjustments; these could be depreciation on property plant & equipment (PPEs), which impact your financial position.

Conclusion:

A classified Balance Sheet is an important tool for any business. It gives maximum details about the structure of the company, allowing one to have an orderly view of its financial position. It further classifies assets, liabilities, and equity which helps in providing a clarity and enhancing the span of financial analysis, besides ensuring compliance with regulatory provisions and proper decision-making. Similarly, a proper preparation and presentation of a classified balance sheet can contribute greatly to the transparency and stability of a company in its finances.

Also Read: Stock Market: The Backbone of the Economy

FAQ’s

Q: The merchandise inventory account on a classified balance sheet is reported in the:

The merchandise inventory account on a classified balance sheet is reported in the “Current Assets” section. Here, it is expected that the merchandise inventory will be sold and changed into cash within one year.

Q: Which of the accounts below would appear in the equity section of a classified balance sheet?

Accounts that typically appear in the equity section of a classified balance sheet include the following: Common Stock Retained Earnings and Additional Paid-in Capital These accounts represent the owners’ residual interest in the company’s assets after liabilities have been deducted.

Q: What is a classified balance sheet, and how does it differ from a simple balance sheet?

A classified balance sheet is a very comprehensive financial statement, wherein assets, liabilities, and stockholders’ equity are appropriately grouped under subheadings. In comparison with a simple balance sheet, where items are listed without segregation, a classified balance sheet provides better clarity and usability by laying down financial data under specific categories.

Q: A classified balance sheet shows subtotals for current and non-current items. What is the significance of these subtotals?

Subtotals for the current and noncurrent items on a classified balance sheet are important because they provide more clarity regarding the liquidity and factors that impact the long-term financial stability of the firm. Likewise, for example, current assets and liabilities help to check the health of the firm’s finances on a short-term basis, on the other hand, noncurrent items yield information on long-term investments and long-term obligations.

Q: How do you prepare a classified balance sheet?

To prepare a classified balance sheet, follow these steps:

- Gather all necessary financial information.

- Classify assets and liabilities as current versus non-current.

- Calculate category totals.

- Equity will be calculated by adding common stock, retained earnings, and additional paid-in capital.

- Present the balance sheet in standard format: organized with clear headings and subheadings separating each category.